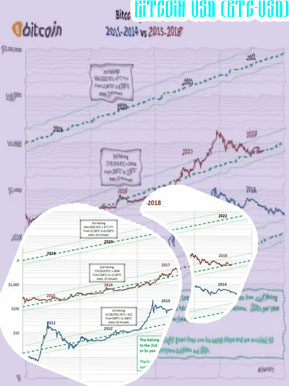

Bitcoin graph

Understanding the intricacies of the Bitcoin graph is essential for anyone looking to navigate the world of cryptocurrency. These three articles delve into different aspects of the Bitcoin graph, providing insights and analysis that can help investors and enthusiasts make informed decisions. From technical analysis to historical trends, these articles offer valuable information for anyone interested in understanding the dynamics of the Bitcoin market.

Bitcoin has become a popular topic in the world of finance, with many investors and traders closely following the price movements of this digital currency. Understanding the fluctuations in the value of Bitcoin can be crucial for making informed decisions when buying or selling. In order to gain a better grasp of the Bitcoin graph, we have compiled a list of two articles that provide valuable insights and analysis on this subject.

Analyzing the Historical Trends of Bitcoin Prices

Bitcoin has been a topic of great interest and speculation in recent years, with many investors eager to capitalize on its seemingly unpredictable price movements. However, by delving into the historical trends of Bitcoin prices, we can gain a better understanding of how this cryptocurrency has evolved over time.

One of the key trends that can be observed when analyzing Bitcoin prices is its volatility. Bitcoin's value has experienced significant fluctuations since its inception, with periods of rapid growth followed by sharp declines. These price swings can be attributed to a variety of factors, including market sentiment, regulatory changes, and technological advancements.

Another important trend to consider is the overall increase in Bitcoin's value over the years. Despite its volatility, Bitcoin has shown a general upward trend in price, with each peak surpassing the previous one. This pattern has attracted many investors looking to benefit from the potential long-term gains offered by this cryptocurrency.

Overall, analyzing the historical trends of Bitcoin prices provides valuable insights into the factors driving its price movements. By understanding these trends, investors can make more informed decisions when it comes to buying and selling Bitcoin.

Feedback from a resident of Madrid, Spain:

"As a resident of Madrid, I have been closely following the fluctuations in Bitcoin prices over the years. Despite the volatility, I have noticed a consistent upward trend

Using Technical Analysis to Predict Bitcoin Price Movements

In the volatile world of cryptocurrency trading, investors are constantly seeking new methods to gain an edge in predicting price movements. One popular strategy that has gained traction in recent years is technical analysis. By analyzing historical price data and market trends, traders can identify potential patterns and trends that may help them forecast future price movements.

Technical analysis involves the use of various tools and techniques, such as chart patterns, indicators, and oscillators, to make sense of the complex and often chaotic market dynamics. By studying price charts and identifying key support and resistance levels, traders can make more informed decisions about when to buy or sell Bitcoin.

One of the key benefits of using technical analysis to predict Bitcoin price movements is its ability to provide traders with a systematic and objective way to analyze the market. By relying on empirical data and mathematical models, traders can avoid the emotional biases that often cloud their judgment.

However, it is important to note that technical analysis is not foolproof and should be used in conjunction with other forms of analysis, such as fundamental analysis and market sentiment. Additionally, it requires a certain level of skill and experience to interpret the various indicators and patterns correctly.

Overall, for traders interested in gaining a deeper understanding of Bitcoin price movements and potentially improving their trading strategies, mastering technical analysis is essential. By

- Bitcoin price over time

- Bitcoin price in 10 years

- Top crypto gainers

- Dogecoin price usd

- Dogecoin 20 where to buy

- Best crypto information websites

- How to buy safemoon on cryptocom

- Cryptocurrency exchanges

- Largest bitcoin holders

- Ethereumx price

- How does bit coin work

- Defi ethereum wall

- Uni crypto

- History of cryptocurrency

- Price of bitcoins in usd

- Doge crypto

- How to withdraw money from cryptocom

- Kasta crypto price

- Bitcoin chart

- Crypto earn

- Cryptocurrency company

- When to buy bitcoin

- Btc live price

- Buy bitcoin cash app

- Buy crypto with credit card

- How to add bank account to cryptocom

- How many btc are there

- Ethusd price

- Bonfire crypto price

- How to sign up for bitcoin

- Why computers won up cracking bitcoin

- Why can't i buy tron on cryptocom

- Mana crypto price

- Who has the most btc

- Bitcoin price binance

- Analysis bitcoin march btc robinson ellipticblog

- How do you buy cryptocurrency

- Cryptocurrency bitcoin price

- Dogecoin app

- Buy btc with credit card

- Current ether price

- Where to buy crypto

- Crypto com not working

- Cryptos

- Cryptocom defi wallet

- 270 addresses are responsible all cryptocurrency

- How does btc mining work

- Litecoin crypto

- Coinbase cryptocurrency prices

- Cryptocom app

- Cryptos to watch

- Btc value usd

- Crypto market live

- Evergrow crypto where to buy

- Bitcoins highest price

- Bitcoins future price

- Bitcoin spot

- Crypto com referral

- New crypto coins

- Crypto exchange

- Crypto to block profits

- Lightcoin price usd

- Bit coin price in us

- Etc crypto

- Crypto to usd

- How to buy crypto on binance

- Best crypto app to buy dogecoin

- Why buy bitcoin

-