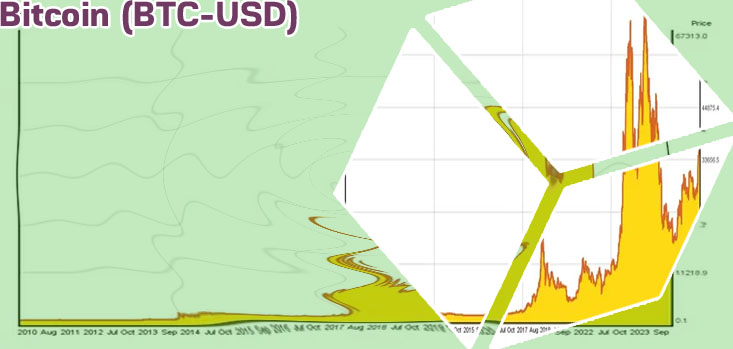

Bitcoin price over time

Bitcoin has been a hot topic in the world of finance, with its price constantly fluctuating over time. Understanding the factors that influence the price of Bitcoin can help investors make informed decisions. In order to shed some light on this topic, here are four articles that delve into the fluctuations of Bitcoin price over time.

Bitcoin has been a hot topic in the financial world, with its price fluctuating dramatically over time. Understanding the factors that influence Bitcoin's price can help investors make more informed decisions. Here are 2 articles that will provide valuable insights into the price movements of Bitcoin:

Analyzing the Historical Trends of Bitcoin Prices

Bitcoin has undoubtedly been one of the most talked-about topics in the financial world in recent years. Its meteoric rise in value and subsequent volatility have made it a subject of interest for investors, economists, and the general public alike. As we delve into the historical trends of Bitcoin prices, we can gain valuable insights into the factors that have influenced its price fluctuations over time.

One of the key trends that have emerged from analyzing the historical data of Bitcoin prices is its extreme volatility. The cryptocurrency market is known for its wild price swings, with Bitcoin being no exception. Factors such as market demand, regulatory developments, and investor sentiment can all contribute to the drastic price movements we have seen in Bitcoin.

Moreover, another trend worth mentioning is the overall upward trajectory of Bitcoin prices over the years. Despite its volatility, Bitcoin has shown a consistent pattern of long-term growth. This has made it an attractive investment option for many individuals looking to diversify their portfolios.

In conclusion, the historical trends of Bitcoin prices reveal a complex interplay of factors that have shaped its value over time. By understanding these trends, investors can make more informed decisions when it comes to buying, selling, or holding onto Bitcoin. As we continue to monitor the cryptocurrency market, it will be interesting to see how these trends evolve

Factors Influencing Bitcoin Price Volatility

Bitcoin, the world's most famous cryptocurrency, is known for its high price volatility. This volatility can be influenced by a variety of factors, including market demand, regulatory changes, macroeconomic trends, and investor sentiment.

One of the key factors influencing Bitcoin price volatility is market demand. When there is increased demand for Bitcoin, its price tends to rise. On the other hand, when demand decreases, the price is likely to fall. This demand can be driven by a variety of factors, including geopolitical events, macroeconomic trends, and mainstream adoption.

Regulatory changes can also have a significant impact on Bitcoin price volatility. In recent years, we have seen various governments around the world taking steps to regulate the cryptocurrency market. These regulations can affect market sentiment and influence the price of Bitcoin.

Moreover, macroeconomic trends, such as inflation and interest rates, can also influence Bitcoin price volatility. Investors often turn to Bitcoin as a hedge against inflation or economic uncertainty, which can lead to increased price volatility.

In conclusion, Bitcoin price volatility is influenced by a complex interplay of factors, including market demand, regulatory changes, macroeconomic trends, and investor sentiment. Understanding these factors can help investors navigate the volatile world of cryptocurrencies.

- Bitcoin price over time

- Bitcoin price in 10 years

- Top crypto gainers

- Dogecoin price usd

- Dogecoin 20 where to buy

- Best crypto information websites

- How to buy safemoon on cryptocom

- Cryptocurrency exchanges

- Largest bitcoin holders

- Ethereumx price

- How does bit coin work

- Defi ethereum wall

- Uni crypto

- History of cryptocurrency

- Price of bitcoins in usd

- Doge crypto

- How to withdraw money from cryptocom

- Kasta crypto price

- Bitcoin chart

- Crypto earn

- Cryptocurrency company

- When to buy bitcoin

- Btc live price

- Buy bitcoin cash app

- Buy crypto with credit card

- How to add bank account to cryptocom

- How many btc are there

- Ethusd price

- Bonfire crypto price

- How to sign up for bitcoin

- Why computers won up cracking bitcoin

- Why can't i buy tron on cryptocom

- Mana crypto price

- Who has the most btc

- Bitcoin price binance

- Analysis bitcoin march btc robinson ellipticblog

- How do you buy cryptocurrency

- Cryptocurrency bitcoin price

- Dogecoin app

- Buy btc with credit card

- Current ether price

- Where to buy crypto

- Crypto com not working

- Cryptos

- Cryptocom defi wallet

- 270 addresses are responsible all cryptocurrency

- How does btc mining work

- Litecoin crypto

- Coinbase cryptocurrency prices

- Cryptocom app

- Cryptos to watch

- Btc value usd

- Crypto market live

- Evergrow crypto where to buy

- Bitcoins highest price

- Bitcoins future price

- Bitcoin spot

- Crypto com referral

- New crypto coins

- Crypto exchange

- Crypto to block profits

- Lightcoin price usd

- Bit coin price in us

- Etc crypto

- Crypto to usd

- How to buy crypto on binance

- Best crypto app to buy dogecoin

- Why buy bitcoin

-