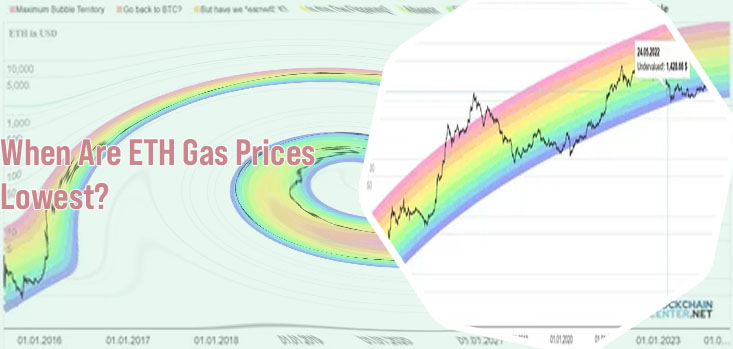

Ethereum price chart

When it comes to tracking Ethereum price movements, having access to reliable and up-to-date information is crucial for making informed investment decisions. In this list, we have curated 3 articles that provide valuable insights into Ethereum price charts, helping readers understand the historical trends, current market conditions, and potential future projections. From technical analysis to expert opinions, these articles offer a comprehensive overview of the factors influencing Ethereum's price movements.

As the cryptocurrency market continues to be a popular investment option, many traders and investors closely monitor Ethereum's price chart to make informed decisions. Whether you are a seasoned trader or new to the world of cryptocurrencies, these three articles will provide valuable insights and analysis on Ethereum's price chart, helping you navigate the volatile market with confidence.

Decoding the Cryptic Patterns of Ethereum Price Chart

A deep dive into the Ethereum price chart reveals a plethora of cryptic patterns that may hold the key to understanding the future movement of this popular cryptocurrency. Ethereum, the second largest digital currency by market capitalization, has been known for its volatile price swings, presenting both opportunities and risks for investors.

One of the key patterns to watch out for is the double bottom formation, which usually indicates a reversal in the current downtrend. This pattern occurs when the price reaches a low point, bounces back up, then falls to a similar level before rebounding again. It signifies a shift in sentiment from bearish to bullish, offering a potential buying opportunity for traders looking to capitalize on the upcoming uptrend.

Another important pattern to consider is the cup and handle formation, which is characterized by a rounded bottom followed by a consolidation period forming a handle. This pattern is typically a bullish indicator, suggesting a potential breakout to the upside. Traders may keep an eye on this pattern as a signal to enter a long position and ride the subsequent price rally.

As a resident of Barcelona, Spain, I have closely observed the movements of Ethereum using the euro as my main currency for trading. I find the insights provided in this article quite valuable in my decision-making process when it comes to trading Ethereum.

Analyzing Ethereum's Price Chart: Trends and Predictions

Ethereum has been one of the most talked-about cryptocurrencies in recent years, and its price chart has been a subject of intense analysis for investors and traders alike. By analyzing the trends and making predictions based on historical data, we can gain valuable insights into the future price movements of Ethereum.

One key trend that we observe on Ethereum's price chart is the long-term upward trajectory. Despite occasional dips and corrections, the overall trend for Ethereum has been bullish, with the price consistently making higher highs and higher lows. This indicates strong demand and investor confidence in the long-term potential of Ethereum.

Another trend to note is the correlation between Ethereum's price and market sentiment. Positive news and developments in the blockchain space often lead to a surge in Ethereum's price, while negative news can trigger a sell-off. By analyzing sentiment indicators and news trends, we can anticipate potential price movements and make informed decisions.

Looking ahead, one prediction for Ethereum is that it will continue to follow the broader trend of the cryptocurrency market. With growing adoption and institutional interest, Ethereum is poised for further gains in the coming months and years. However, it is essential to remain cautious and stay updated on market developments to navigate the volatility effectively.

Mastering Technical Analysis for Ethereum Price Chart

Cryptocurrency enthusiasts and traders looking to deepen their understanding of Ethereum price chart analysis will find this book to be an indispensable resource. The author's expertise in technical analysis shines through as they guide readers through the various indicators, chart patterns, and strategies specific to Ethereum trading.

One key takeaway from the book is the importance of recognizing support and resistance levels on Ethereum price charts. By understanding these critical levels, traders can make informed decisions about entry and exit points, as well as manage risk more effectively. Additionally, the book delves into the concept of trendlines and how they can be used to identify potential price reversals or continuations in Ethereum's price movement.

Another valuable aspect of the book is the discussion on trading volume and its significance in Ethereum price analysis. By learning how to interpret volume patterns alongside price movements, traders can gain deeper insights into market sentiment and potential price direction.

Overall, "Mastering Technical Analysis for Ethereum Price Chart" is a comprehensive guide that equips readers with the necessary tools and knowledge to conduct thorough analysis of Ethereum price charts. Whether you're a novice trader or an experienced investor, this book is sure to enhance your understanding of Ethereum trading strategies.

Key Takeaways:

- Recognizing support and resistance levels

- Understanding trendlines for price analysis

- Bitcoin price over time

- Bitcoin price in 10 years

- Top crypto gainers

- Dogecoin price usd

- Dogecoin 20 where to buy

- Best crypto information websites

- How to buy safemoon on cryptocom

- Cryptocurrency exchanges

- Largest bitcoin holders

- Ethereumx price

- How does bit coin work

- Defi ethereum wall

- Uni crypto

- History of cryptocurrency

- Price of bitcoins in usd

- Doge crypto

- How to withdraw money from cryptocom

- Kasta crypto price

- Bitcoin chart

- Crypto earn

- Cryptocurrency company

- When to buy bitcoin

- Btc live price

- Buy bitcoin cash app

- Buy crypto with credit card

- How to add bank account to cryptocom

- How many btc are there

- Ethusd price

- Bonfire crypto price

- How to sign up for bitcoin

- Why computers won up cracking bitcoin

- Why can't i buy tron on cryptocom

- Mana crypto price

- Who has the most btc

- Bitcoin price binance

- Analysis bitcoin march btc robinson ellipticblog

- How do you buy cryptocurrency

- Cryptocurrency bitcoin price

- Dogecoin app

- Buy btc with credit card

- Current ether price

- Where to buy crypto

- Crypto com not working

- Cryptos

- Cryptocom defi wallet

- 270 addresses are responsible all cryptocurrency

- How does btc mining work

- Litecoin crypto

- Coinbase cryptocurrency prices

- Cryptocom app

- Cryptos to watch

- Btc value usd

- Crypto market live

- Evergrow crypto where to buy

- Bitcoins highest price

- Bitcoins future price

- Bitcoin spot

- Crypto com referral

- New crypto coins

- Crypto exchange

- Crypto to block profits

- Lightcoin price usd

- Bit coin price in us

- Etc crypto

- Crypto to usd

- How to buy crypto on binance

- Best crypto app to buy dogecoin

- Why buy bitcoin

-