Crypto exchange volume

When it comes to understanding and improving crypto exchange volume, it is important to stay informed on the latest strategies and trends in the industry. Below are two articles that provide valuable insights and tips on how to increase trading volume on crypto exchanges.

Cryptocurrency exchange volume is a crucial metric for investors and traders looking to understand market trends and make informed decisions. In order to delve deeper into this topic, we have compiled a list of three articles that provide valuable insights into crypto exchange volume and how it can impact the digital asset market.

Understanding the Importance of Crypto Exchange Volume in Market Analysis

Cryptocurrency exchange volume plays a crucial role in market analysis, offering valuable insights into market trends and investor sentiment. By understanding and analyzing exchange volume, traders and investors can gain a better understanding of the market dynamics and make more informed decisions.

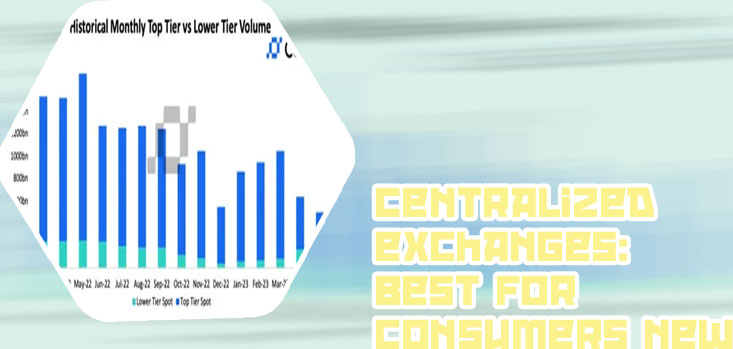

Exchange volume refers to the total number of cryptocurrencies traded on a particular exchange within a specific period. High trading volume indicates increased market activity and interest, while low volume may indicate a lack of interest or market stagnation. In general, higher trading volume is often associated with greater price volatility and liquidity, making it an important indicator for market analysis.

Analyzing exchange volume can help traders identify potential buying or selling opportunities, as high trading volume often precedes significant price movements. It can also help identify market trends and patterns, allowing traders to make more accurate predictions about future price movements. Additionally, monitoring exchange volume can help traders identify potential market manipulation or irregularities.

In order to better reveal the content of this article, readers should consider looking at specific exchange volume metrics such as trading volume by currency pairs, trading volume over time, and trading volume compared to historical data. Additionally, readers should explore the relationship between exchange volume and price movements, as well as the impact of exchange volume on market liquidity. By delving deeper into these topics, readers can gain

Top Factors Influencing Crypto Exchange Volume

In the fast-paced world of cryptocurrency trading, it is crucial to understand the various factors that influence exchange volume. By taking a closer look at these key elements, traders can make more informed decisions and potentially increase their profits. One of the most significant factors affecting exchange volume is market sentiment. Traders often react to news and events in the crypto space, leading to fluctuations in trading volume. For example, positive news such as the adoption of blockchain technology by a major corporation can attract more traders to the market, resulting in increased volume.

Another essential factor influencing exchange volume is regulation. Government regulations and policies can have a significant impact on the crypto market, affecting trading volume as well. For instance, a country banning the use of cryptocurrencies can lead to a decrease in trading activity on exchanges located in that region. Additionally, the usability and user experience of an exchange platform can also influence trading volume. Traders are more likely to use exchanges that are user-friendly and offer a wide range of trading pairs.

Overall, understanding the top factors that influence exchange volume is crucial for traders looking to navigate the complex world of cryptocurrency trading. By keeping a close eye on market sentiment, regulation, and usability, traders can stay ahead of the curve and make better-informed decisions.

Strategies for Increasing Trading Volume on Crypto Exchanges

In the fast-paced world of cryptocurrency trading, increasing trading volume is crucial for exchanges to stay competitive and attract more traders. To achieve this, exchanges can employ various strategies that have been proven to be effective.

One key strategy is to offer a diverse range of cryptocurrencies for trading. By providing traders with access to a wide selection of digital assets, exchanges can appeal to a broader audience and attract more users. Additionally, offering trading pairs with popular cryptocurrencies such as Bitcoin and Ethereum can help increase liquidity and trading volume on the platform.

Another effective strategy is to incentivize traders to increase their trading activity. This can be done through various means, such as offering discounts on trading fees for high-volume traders or running promotions and contests to reward active traders. By creating incentives for traders to increase their trading volume, exchanges can stimulate trading activity and boost overall trading volume.

Furthermore, exchanges can enhance their marketing efforts to reach a larger audience of potential traders. By leveraging social media, influencer partnerships, and targeted advertising campaigns, exchanges can raise awareness of their platform and attract new users to increase trading volume.

In conclusion, implementing strategies such as offering a diverse range of cryptocurrencies, incentivizing traders, and enhancing marketing efforts can help exchanges increase trading volume and stay competitive in the ever-evolving cryptocurrency market.

- Bitcoin price over time

- Bitcoin price in 10 years

- Top crypto gainers

- Dogecoin price usd

- Dogecoin 20 where to buy

- Best crypto information websites

- How to buy safemoon on cryptocom

- Cryptocurrency exchanges

- Largest bitcoin holders

- Ethereumx price

- How does bit coin work

- Defi ethereum wall

- Uni crypto

- History of cryptocurrency

- Price of bitcoins in usd

- Doge crypto

- How to withdraw money from cryptocom

- Kasta crypto price

- Bitcoin chart

- Crypto earn

- Cryptocurrency company

- When to buy bitcoin

- Btc live price

- Buy bitcoin cash app

- Buy crypto with credit card

- How to add bank account to cryptocom

- How many btc are there

- Ethusd price

- Bonfire crypto price

- How to sign up for bitcoin

- Why computers won up cracking bitcoin

- Why can't i buy tron on cryptocom

- Mana crypto price

- Who has the most btc

- Bitcoin price binance

- Analysis bitcoin march btc robinson ellipticblog

- How do you buy cryptocurrency

- Cryptocurrency bitcoin price

- Dogecoin app

- Buy btc with credit card

- Current ether price

- Where to buy crypto

- Crypto com not working

- Cryptos

- Cryptocom defi wallet

- 270 addresses are responsible all cryptocurrency

- How does btc mining work

- Litecoin crypto

- Coinbase cryptocurrency prices

- Cryptocom app

- Cryptos to watch

- Btc value usd

- Crypto market live

- Evergrow crypto where to buy

- Bitcoins highest price

- Bitcoins future price

- Bitcoin spot

- Crypto com referral

- New crypto coins

- Crypto exchange

- Crypto to block profits

- Lightcoin price usd

- Bit coin price in us

- Etc crypto

- Crypto to usd

- How to buy crypto on binance

- Best crypto app to buy dogecoin

- Why buy bitcoin

-